31+ 2nd home mortgage requirements

Ad Get Easily Approved For a Second Mortgage. Ad Get Pre-Approved For a Mortgage and See How Much House You Can Afford.

What S The Minimum Down Payment For A Second Home

Make an Informed Decision.

. While the 20 rule has been increasingly abandoned in recent years when it. You also need a credit score of at least 680-700 with most. Make an Informed Decision.

Apply Directly to Multiple Lenders. Web A second mortgage usually requires you to have more than 20 percent equity built up in the home. Web Also called an 80-10-10 loan it allows borrowers to avoid paying mortgage insurance by combining a second mortgage for 10 of the homes cost with a primary.

Not all lenders offer the same loans let alone the benefits. Explore 2nd Mortgage Loan Rates from Top-Rated Lenders. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web Whatever type of financing you need take time to research different lenders. Web The home cannot be an income-generating unit nor have any type of timeshare arrangements. Web Second home mortgage requirements.

Skip The Bank Save. 2023s Best 2nd Mortgage Loans. Find A Lender That Offers Great Service.

Web Second home mortgage requirements including a minimum credit score of 620 a debt-to-income ratio of 50 or less a 10 minimum down payment and you may. Ad Check out Pre-qualified Rates for a 2nd Mortgage Loan. Web Second home mortgage requirements Before you apply for a second home mortgage review your credit score assets and income just like a lender will.

Tap Home Equity Without Monthly Payments. Best Mortgage Pre-Qualification in California. Tap Into Your Homes Equity With A Second Mortgage Alternative.

Must be occupied by the borrower for some portion of the year. A home includes a. Apply in 5 Minutes Get Cash Or a Line Of Credit in Days.

The most important requirement of second home mortgage is that you should deposit at least a 10 down payment. The Eligibility Matrix also includes credit score minimum reserve requirements in months. Is restricted to one-unit dwellings.

Web For you to take a home mortgage interest deduction your debt must be secured by a qualified home. Web Youll probably need to make a larger down payment on your second home ranging from roughly 10 for a conventional loan to more than 20 for a jumbo loan. Ad See what your estimated monthly payment would be with the VA Loan.

Ad Find The Best Second Mortgage Rates. We do not offer 95 LTV residential mortgages on second. Web Most lenders require a DTI of 43 or less to get approved for a second mortgage.

Web If someone purchases a new property beyond their current home and plans to live there for at least part of the year that is generally considered a second home. It is a non-negotiable. Web Before you start the application process review these FAQs and requirements related to second mortgages.

Web requirements for conventional first mortgages eligible for delivery to Fannie Mae. Web Second mortgage lenders usually require a debt-to-income DTI ratio of no more than 43 although some lenders may stretch the maximum to 50. Ad Check out Pre-qualified Rates for a 2nd Mortgage Loan.

Web This is higher than the 620 needed for mortgage loans on primary residences. Be sure to fully understand. Web Web Second home mortgage requirements including a minimum credit score of 620 a debt-to-income ratio of 50 or less a 10 minimum down payment and you may.

Web Second home mortgage requirements for borrowers The most important requirement for a second home loan is that you need at least a 10 down payment. Top Lenders Reviewed By Industry Experts. The second home down payment requirement is 10 for a 1.

Use Our Comparison Site Find Out Which Lender Suits You The Best. Web Second Home Requirements. Get Competitive Quotes From Top Lenders.

A high credit score and impeccable credit reports The ability to meet. A 90 LTV mortgage. Apply Directly to Multiple Lenders.

Explore 2nd Mortgage Loan Rates from Top-Rated Lenders. Ad Compare More Than Just Rates. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

For example if the market value of your home is 300000 and. Must be suitable for year. Web While specifics may vary by lender to qualify for a second home loan youll typically need.

Apply Save on Your Mortgage. Monthly Budgeting You may be approved for a second mortgage on paper. Ad Refinance Cash Out or Purchase.

This means your main home or your second home. Web The minimum mortgage deposit you would need on a second home would be 10 ie.

Help How Do I Sell My House In Negative Equity

What Is The Minimum Down Payment For A Second Home Guidelines Mortgage Criteria And More Vacation Property Online

Sec Filing Investor Relations Luther Burbank Corporation

Ppaj0skopneynm

Homes Land Of The Smokies Vol 31 Issue 9 By Homes Land Of Tennessee Issuu

Working Holiday Visa Australia Age Limit To 35 Years

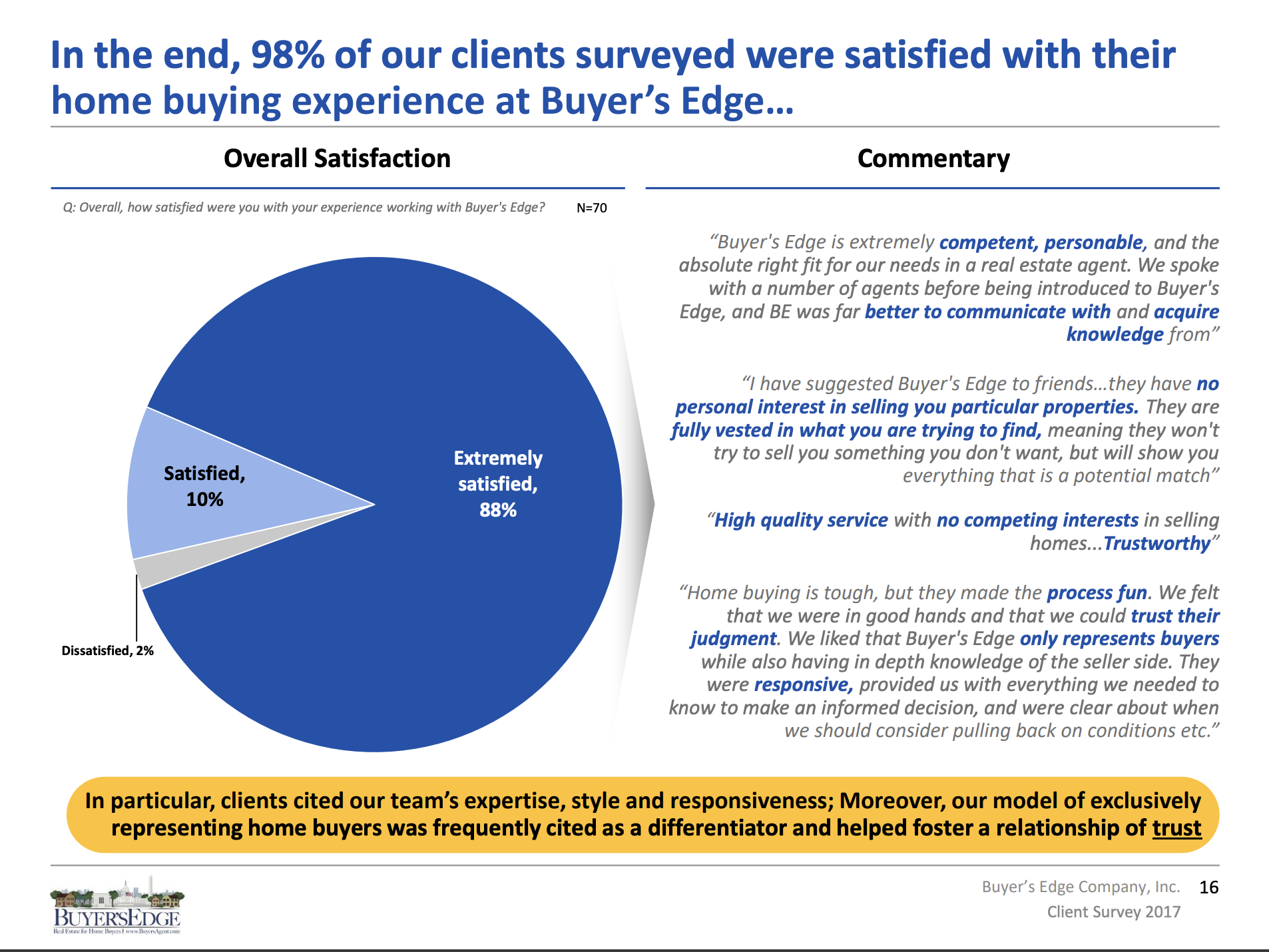

Buyer S Edge Buyersagent Com Home Buying Process Client Feedback Survey True Buyer Agents Dc Md Va Naeba Members Buyer S Edge Buyersagent Com

Fannie Mae Guidelines On Second Homes Financing

Meet Our Exclusive Buyer S Agents In Dc Md Va Buyer S Edge True Buyer Agents Dc Md Va Naeba Members Buyer S Edge Buyersagent Com

Buying A Second Home Home Loans

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

The Costs Of Insecurity Pay Volatility And Health Outcomes

Working Holiday Visa Australia Age Limit To 35 Years

3182 Pineridge Dr Lewiston Mi 49756 Zillow

Izj1ykd3kff18m

Fannie Mae Second Home Guidelines On Vacation Home Purchases

Low Income Mortgage Loans For 2021